Prichard shares info about new COVID-19 stimulus law

By James Grob, jgrob@charlescitypress.com

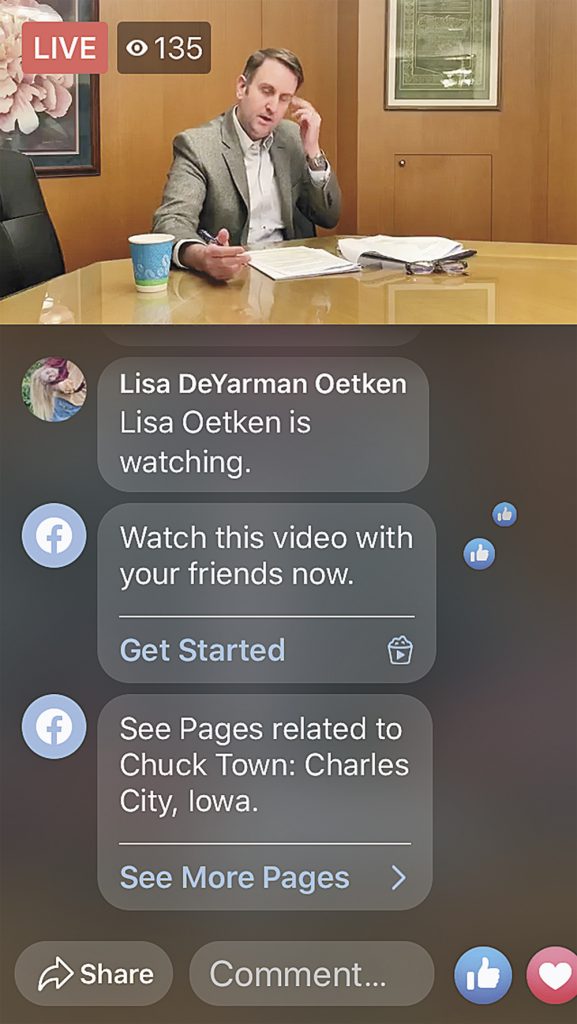

Iowa House Minority Leader Todd Prichard, D-Charles City, held a Facebook Live chat Monday to update constituents regarding the federal Coronavirus Relief Act, which was signed into law on Friday.

The $2 trillion stimulus plan is the latest federal response to the COVID-19 pandemic, and is said to be the largest relief effort in U.S. history. It includes support for health care workers, businesses and employees impacted by the coronavirus. Millions of Americans will also get stimulus deposits or checks beginning in April.

The live web broadcast was facilitated by Mark Wicks, director of the Charles City Area Chamber of Commerce, as Prichard explained what people can expect from the new law.

“There’s a lot of money flowing in a lot of different directions to a lot of industries here,” Prichard said during the live chat, which is the second such event he’s held in as many weeks.

Prichard, an attorney, said that among many other things, the stimulus law provided for $500 billion for businesses as well as $140 billion for rural hospitals and Medicaid providers, $30 billion for educational institutions and $25 billion for agriculture interests.

He referred viewers to the Small Business Administration website as well as the Iowa Economic Development website for more on these programs and others.

He said the most-discussed provision of the law provides $1,200 direct payments to individuals, designed to immediately put money in the pockets of taxpayers.

“Those checks should start coming out on April 6,” Prichard said. “I imagine it will take a few weeks for them to reach everyone.”

Most people who listed bank information for direct deposit of refunds on their 2018 or 2019 tax returns will receive the stimulus money the same way.

Prichard called the money a refundable credit, which taxpayers will eventually pay back.

“This is not free money,” he said. “This is an advance on a future refund.”

Taxpayers will receive a $1,200 individual grant, for individuals who showed income under $75,000 on their most recent tax return and $2,400 for married couples who earned under $150,000 on their taxes.

Individuals who earned between $75,000 – $99,000 will receive a lesser amount and individuals who made $100,000 or more will not get this benefit. There will also be lesser amounts for couples who earned between $150,000 – $199,000 and no benefit for couples who earned $200,000 or more.

“This also provides $500 of additional money per dependent under 17 years of age,” Prichard said. “This information is taken from your 2020 return if you’ve already filed it, or from your 2019 return if you have not filed yet in 2020.”

Prichard said a good portion of the money provided in the law will be allocated to rural hospitals and medical providers.

“There’s a large amount of money for the health care industry here,” he said. “There’s $140 billion for the Department of Health and Human Services to help with some of the costs for Medicare and Medicaid. This money is designed to speed up payment for providers.”

Prichard also said the law allocated $30 billion for the education stabilization fund for states, with specific grants for colleges and universities as well as for elementary and secondary education.

“If you are a school administrator or something like that, be looking for some of this money available now,” Prichard said. “Beyond education, there’s a significant amount of money for the agriculture sector here, too.”

Agricultural money includes $14 billion for the Commodity Credit Corporation — a government-owned and operated entity created to stabilize, support, and protect farm income and prices. Prichard said there was also $9.5 billion in assistance for crops and livestock.

Prichard said the new law also changed some rules for withdrawals from retirement funds.

“If you’re a small business, one way for you to access capital is through your retirement fund,” Prichard said. “They’ve loosened the restrictions for you to borrow against your own retirement account.”

Prichard mentioned Paycheck Protection Program loans.

“These are loans through the Small Business Administration that are designed to help you maintain your payroll through this downturn,” Prichard said. “In many cases, these are forgivable loans.”

Forgiveness can be for up to eight weeks of payroll, based on employee retention and salary levels. Small businesses are able to apply if they were harmed by COVID-19 between Feb. 15 and June 30.

“This is available to both private businesses and non-profit organizations,” said Prichard, who added that sole proprietors and independent contractors are also eligible.

Small business debt relief is also available during the COVID-19 crisis, as are many emergency grants and loans, according to Prichard. Deferrals are also available for payment of payroll taxes, and there is a payroll tax credit for certain businesses that retain and pay employees during the crisis.

“This can be a tax credit of up to 50% of wages paid by eligible employers,” Prichard said. “Wages of employees who are furloughed, or face reduced hours because of economic hardship, are eligible for this credit.”

Prichard said the employee retention credit applies to businesses with 100 employees or fewer.

“There are a lot of questions in my community and around the state about unemployment,” Prichard said. “If someone is not working because of COVID-19, they do not have to go into the normal requirements of trying to find employment and things like that. They should be eligible week to week.”

He said that through the new stimulus law, people who are self-employed, independent contractors, non-profit employees and gig economy workers are now eligible for unemployment, and that those people should check Iowa Workforce Development’s website for more information.

Social Share