Final Floyd County property tax rate is a mixture of many variables

By Bob Steenson, bsteenson@charlescitypress.com

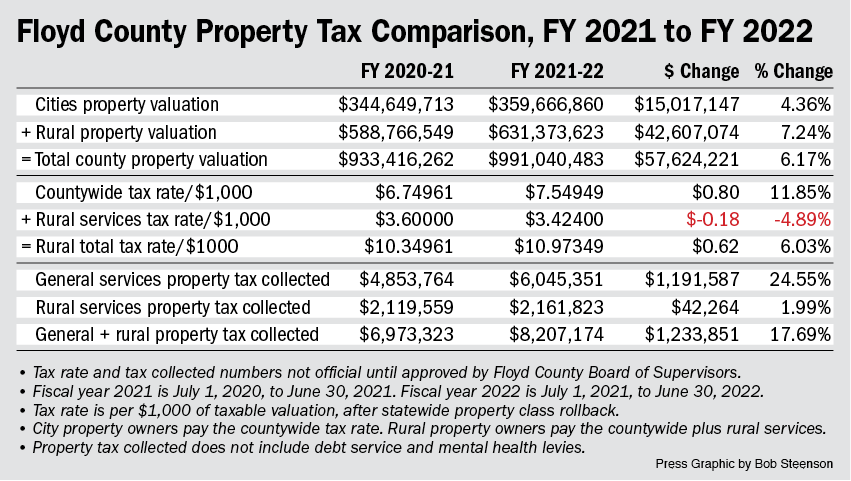

Using current figures, Floyd County’s countywide tax rate would increase 11.85% for the new fiscal year that will begin July 1.

The county property tax rate paid by rural residents would increase by 6.03%.

Actual county property tax bills are likely to go up even more, because valuations have increased on average, and the state rollback has decreased.

The county currently plans on collecting $7.55 per $1,000 of taxable valuation next fiscal year, up about 80 cents from the current $6.75. That’s the amount paid by all property owners in the county.

People who live in the rural areas of the county pay an additional rural services levy, for the services that the county provides for them that people who live in cities get from their city, such as law enforcement, access to libraries, weed control, sanitary disposal and road clearing.

The rural services tax levy is actually declining, but because property values increased, the total amount of taxes collected from the rural services levy will increase.

The total county tax rate for property in the unincorporated areas of the county next fiscal year is projected at $10.97 per $1,000 of taxable valuation, up about 62 cents from the current $10.35 per $1,000.

Those tax rate figures are important in determining the property tax bill that will be paid by county property owners, but they’re only part of the total picture.

For instance, many people’s assessed property value increased from one year to the next. In that case their property taxes would increase even if the tax rates remained the same.

The total property valuation in Floyd County increased from $933.4 million in the current fiscal year to $991.0 million next year, an average increase of 6.2%, although some of that was because of new development and new construction, not just an increase on existing properties.

Combining the valuation increase and the tax rate increases, the total property tax the county expects to collect will increase from this year’s $6.973 million to $8.207 million next year — an increase of $17.7% or almost 1¼ million dollars.

People and businesses actually pay taxes on only part of the real value of their property.

By law, the assessed value of property is supposed to represent the true market value of that property. But in order to prevent property taxes from increasing too rapidly, the state applies what is called a rollback — taxing only a part of the actual value.

For, example, for the current fiscal year, the rollback for residential property, including dwellings located on agricultural property, is 55.07%, meaning you’re only paying taxes on 55.07% of the assessed value, or about $110,140 for a $200,000 home.

For fiscal year 2022, the residential rollback is 56.41%, meaning you’re paying taxes on a higher percentage of the true value, or about $112,820 on a $200,000 home. If everything else stayed the same, that change in the rollback just increased your property taxes by 2.4%.

Commercial and industrial property, multi-residential property and ag land each has its own rollback percentage.

On top of all that, there are various credits that some people are eligible for and others aren’t, such as the homestead credit, military exemption or family farm credit.

The biggest factor affecting total property taxes is what all the other taxing bodies do.

For example, for the current year, Floyd County property taxes represent less than a fifth of the total property tax bill paid for property owners in Charles City. Much larger amounts go to the school district and the city. Lesser amounts go to the county hospital, community college, assessor, ag extension and the state.

County Auditor Gloria Carr offered the example of a Charles City home currently assessed at $210,980. Taking into account only the increase in valuation and the decrease in the residential rollback, the taxable value of that property increased from $116,195.76 to $125,087.85.

That’s a 7.75% increase in taxable value regardless of the tax rates.

If she keeps the tax rate charged by Charles City, the Charles City School District, NIACC, the medical center and the others the same from the current year and the next fiscal year, and only includes the increase in the taxable value and the increase in the Floyd County tax rate, and including a homestead credit, the taxes on the property will increase from the current year $4,235.88 to next fiscal year’s $4,649.18, an increase of $413.30, or 9.76%.

In this example, Floyd County property taxes account for 19.5% of the total property tax bill on this property.

Social Share