500 North Grand apartment project in Charles City gets state tax credit boost

By Bob Steenson, bsteenson@charlescitypress.com

The project to convert the historic former Charles City Middle School into 40 residential apartments got a big boost Monday with the announcement that the Iowa Economic Development Authority has awarded the project almost $1.7 million in state income tax credits.

The project, under the name 500NorthGrandHomes LLC, will receive $1,696,050 toward the project being developed by Shawn Foutch, an owner of JMAE LLC.

“Award of these credits is critical to the project,” Foutch told the Press on Monday.

“We’ve been working to get this award for years. Now that we have it, we can get the project moving again,” he said. “Our project management team met this morning to get the project moving again.”

The Iowa Economic Development Authority (IEDA) announced more than $43 million in awards on Monday to help transform 10 historic buildings through the Historic Preservation Tax Credit program.

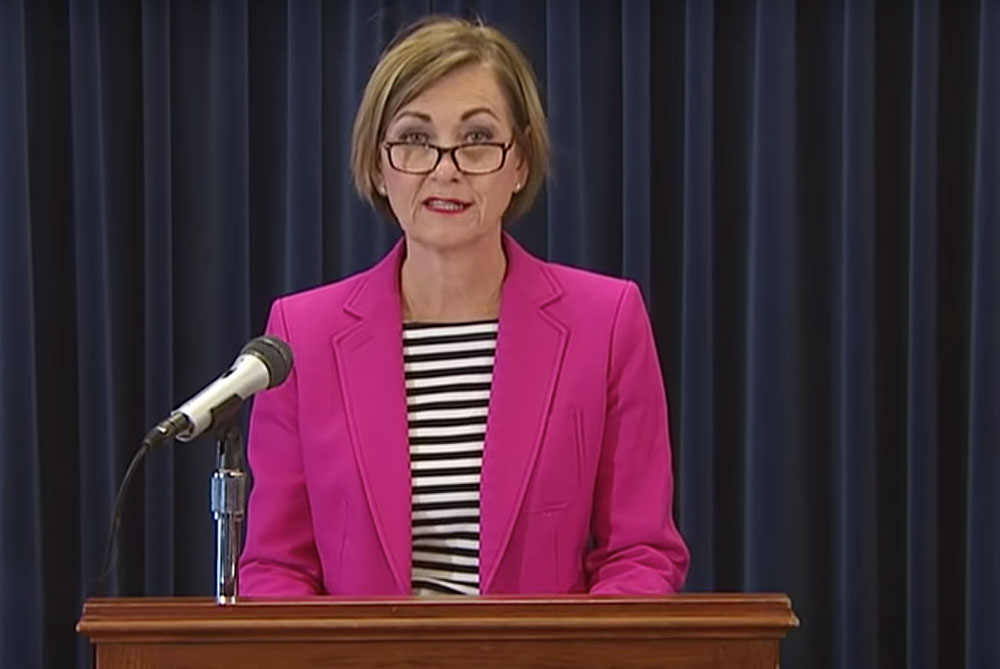

“Historic buildings are tangible symbols of a community’s past, and repurposing these gems creates such character-rich spaces for new opportunities,” said Debi Durham, director of IEDA and the Iowa Finance Authority.

“In addition, these projects often serve as a catalyst for the redevelopment of a block, a street or a district,” she said.

The Historic Preservation Tax Credit program provides state income tax credits to projects that rehabilitate underused or vacant historic buildings while maintaining the historic character-defining features that enhance neighborhoods and communities, according to IEDA.

The tax credits can fund up to 25% of the qualified rehabilitation expenditures associated with a project. The credits are transferable, allowing recipients to sell them to other taxpayers for project funding if the recipients cannot fully utilize the credits themselves.

In July, while giving a tour of the school building and the interior progress so far, Foutch had told IEDA Director Durham about the delays in receiving a response on his applications for state and federal tax credits that had stalled the project at that point.

Fourth said that the Charles City building is in the best physical condition of any of the dozen projects he has done converting old school buildings into apartments, and that seemed to be one of the reasons for the delays.

Work completed on buildings must meet the Secretary of the Interior’s Standards for Rehabilitation, according to the IEDA, and Foutch said one problem with the building being in such good shape is the State Historic Preservation Office and the National Park Service love the building so much that they were being exceptionally picky about what changes they were allowing Foutch to make.

Durham had promised to see what she could do to move the state approval along.

The 40 units will range from studio apartments to three bedrooms, will have high ceilings, hardwood cabinets, granite countertops, and an average of just under 1,000 square feet, Foutch said. Also available for residents will be a fitness center, a meeting room and access to the existing 500 North Grand auditorium.

“When we’re done with the school it will still look like a school from the outside. It will still look like a school from the hallways, but as soon as you walk into an apartment, you walk through the historic classroom door and then all of a sudden it looks like an apartment,” Foutch said about his plans.

Foutch said in July that the entire project will be about $7.6 million, which includes $2.4 million in combined state and federal historic tax credits, $1.1 million from his own funds, $500,000 in grayfield funding, and $3.6 million in long-term financing.

“That’s kind of a standard formula for how we try and pull these together,” Foutch said.

The IEDA’s project description for the Charles City project in the award notification identifies it as “Conversion of building into 40 apartments. Highly ornate auditorium will be left in place.”

The most recent application round opened in January with approximately $43 million available for awards. IEDA said it received 13 applications requesting more than $63 million in tax credits. Projects are scored based on readiness, financing and local support and participation, the announcement said.

This latest round of awards, in addition to the Charles City project, went to:

- Coe College dormitory rehabilitation, Cedar Rapids – $564,348.

- Strand Theatre exterior rehabilitation, Cedar Rapids – $2,097,252.

- Financial Center Office Building conversion into 190 apartments and commercial space, Des Moines – $16,928,750.

- Ingersoll Theatre rehabilitation of vacant building to hold live events, Des Moines – $728,818.

- Ruan Tower and Banking Pavilion rehabilitation, Des Moines – $7,222,338.

- Roshek Bros. Second Department Store conversion into 36 apartments and commercial space, Dubuque – $2,545,857.

- St. Raphael Cathedral and Rectory rehabilitation, Dubuque – $1,886,261.

- McKee Button Co. conversion into office space, Muscatine – $5,586,500.

- East Junior High School redevelopment into apartments, Sioux City – $3,955,461.

Social Share