Charles City Main Street’s McQuillen Place is sold, but will sale stick?

By Bob Steenson, bsteenson@charlescitypress.com

A new company formed by First Security Bank & Trust’s holding company has purchased the assets of McQuillen Place Co. and plans to make the Main Street building ready for sale to a developer to finish and manage the project.

But whether that sale remains valid may turn on a constitutional law question that potentially pits two parts of the United States Code — Title 11 Bankruptcy and Title 17 Copyright — against each other.

A 14-day stay, or waiting period, ended last Friday on an order by a federal bankruptcy court judge, giving the trustee in the chapter 7 bankruptcy case involving McQuillen Place Co. LLC permission to sell the assets of the company to the bank, which holds the note on a construction loan for the property.

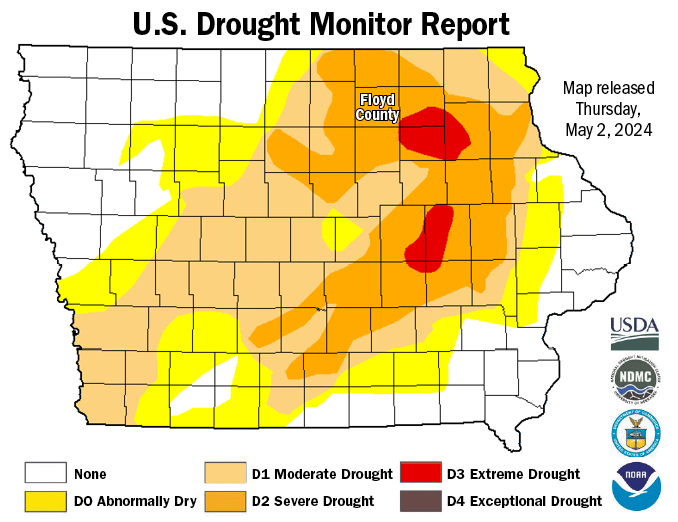

The bank assigned its purchase rights to the new company, Four Keys LLC, which bought the assets and closed on the property Friday morning, according to records filed in U.S. Bankruptcy Court in Cedar Rapids and a deed filed in Floyd County.

Kurt Herbrechtsmeyer, president and CEO of First Security, said the bank’s holding company formed the new company, Four Keys, on the advice of its attorneys “to move it out of the bank – account for it separately.”

“Cedar Valley Bankshares, which owns the bank, created the entity Four Keys LLC. The purchase was actually made by Four Keys LLC,” Herbrechtsmeyer said. “It allows a different group to focus on managing, taking care of the property and dealing with getting it sold. The bankers can be bankers.”

A bank holding company is a company that owns and/or controls banks, but does not offer any banking services itself. In the case of both Cedar Valley Bankshares and First Security Bank & Trust, state records show most of the ownership and control are in the same families’ hands.

Herbrechtsmeyer said Four Keys would hire a person to take care of the property, to get it cleared out and ready for potential developer-purchasers to walk through and decide if they are interested in making an offer, and potentially hire a real estate agent as well.

He said Four Keys will not be the developer.

“Absolutely the plan is to sell it,” he said. “We’ve already had contacts about buying it. There are materials in there, there is equipment that belongs to others, the architect. We want to get the place cleaned out. … and make sure that everything’s ready to go.”

One of the things that needs to get done soon is to get the elevator in the three-story mixed residential and commercial building operating, Herbrechtsmeyer said.

Schindler Elevator Corp. of Morristown, New Jersey, has a mechanic’s lien on the property for almost $54,000 for equipment and work in 2017 that it says was not paid for, according to the Iowa Secretary of State’s office.

“Obviously Schindler needs to get the work completed and get the elevator working. One of the plans would be, here shortly, to get them paid for their mechanic’s lien and get them engaged to come back and complete it,” Herbrechtsmeyer said.

The McQuillen project, planned to offer 33 residential apartments on the second and third floors and retail or commercial space on the ground floor, was announced in 2013. A majority of the construction has been completed, but in 2017 work stalled for a variety of reasons.

Since then the project has been entangled in a legal labyrinth of lawsuits and counter suits in state and federal courts, an attempt at foreclosure on the part of First Security Bank, then filing Chapter 11 bankruptcy by the project’s owner, McQuillen Place Co. LLC.

Last year the bankruptcy judge in the case converted the Chapter 11 reorganization bankruptcy to Chapter 7 and appointed a trustee to oversee selling the assets of McQuillen Place Co. LLC.

On April 8 a hearing was held by telephone and as a result of that hearing, the bankruptcy judge ordered that the appointed trustee, Chuck Smith, a Cedar Falls attorney, could sell the assets to the bank after the 14-day stay period, which ended last Friday and resulted in the sale and closing on the property Friday morning.

However, the day before, on Thursday, motions were filed in the bankruptcy court, asking the judge to reconsider his decision and elaborating on a copyright claim on the design of the building that had been emphasized by the project architect’s attorney during the April 8 hearing.

A hearing has been set on those motions for Friday, May 8.

Smith, the trustee, who has talked to the Press several times in the past regarding the bankruptcy process, said Tuesday he had no comment on the latest developments.

One of the motions to reconsider was filed by Charles Thomson and James Gray, equity security holders in McQuillen Place Co.

Thomson is a Charles City attorney, the primary originator of the project and 60% equity owner. Gray is 40% equity owner in McQuillen Place Co., and is president and owner of Cornice & Rose International, a Chicago-area architectural and construction company that did the design and organized much of the construction that has taken place on the project.

The Thompson and Gray motion argues that the judge failed to rule on a request by Thomson to be able to question the bankruptcy trustee under oath regarding his statements and actions in the case, and regarding affidavits filed in the case.

“Failure to permit the cross-examination together with omitting any ruling on the request creates a gap in due process,” Thomson wrote, adding that the failure could be used to call into question the validity of a sale of the property.

Two other motions were filed by Cornice & Rose, Gray’s company, regarding what the company says are its copyright rights to the design of the building.

In one motion filed in the bankruptcy court, and in another motion filed in U.S. District Court, Cornice & Rose argues that the order to allow the sale of the property violates the company’s rights in an area that is not within the bankruptcy court’s ability to decide.

“As the owner of the copyrights in the architectural works at issue, C&R has the exclusive rights to that design provided by the Copyright Act,” the Cornice & Rose suit says, arguing that the bankruptcy judge does not have the power to make rulings that affect that copyright.

Federal law gives bankruptcy court judges wide latitude in being able to bring cases to a resolution, but it restricts judges from ordering actions that are opposed by other statutes or codes, and requires some topics that are not considered to be “core proceedings” regarding bankruptcy to be decided by a U.S. district court unless all the sides in the bankruptcy case agree to allow the bankruptcy judge to decide it.

Cornice & Rose argues that the judge’s order on the sale of the property violates the company’s rights under Title 17, the copyright code, and constitutes errors of law that must be corrected.

Because of the way the judge ruled, “plainly enforceable substantive rights of C&R in and to its intellectual property may be extinguished or subjected to needless legal controversy,” the Cornice & Rose motion argues.

First Security’s Herbrechtsmeyer said he doesn’t know what impact the scheduled hearing next Friday might have on the project or the sale that has already taken place, but now additional attorneys — copyright attorneys — have joined the process on each side.

“We need to understand what our risks are with going forward with (Four Keys) selling it or how that can be resolved,” Herbrechtsmeyer said.

“You want to make sure that you’re gonna sell something that you can transfer cleanly to a buyer. We want that and the buyer wants that, so we want to be sure that can happen,” he said.

Thomson told the Press Thursday, “We are asking, essentially, that the sale order be vacated so we can revisit the problems that were present before the sale order was entered, and those problems have to do with due process and with the effect of Title 17 on the property.

“Our argument will be the sale is ineffective until these issues are resolved,” Thomson said.

Social Share