Floyd County supervisors reduce maximum property tax allowed in next fiscal year

By Bob Steenson, bsteenson@charlescitypress.com

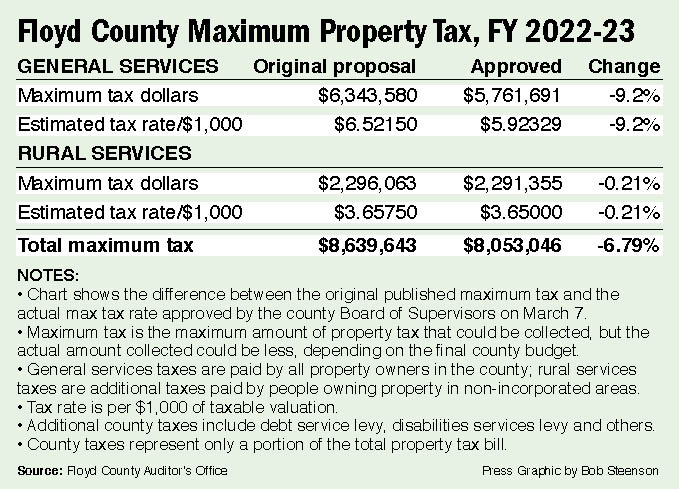

After another two hours of letting county residents vent their frustration over proposed property tax increases and county spending levels, the Floyd County Board of Supervisors passed a “maximum tax” resolution with numbers lower than those originally proposed.

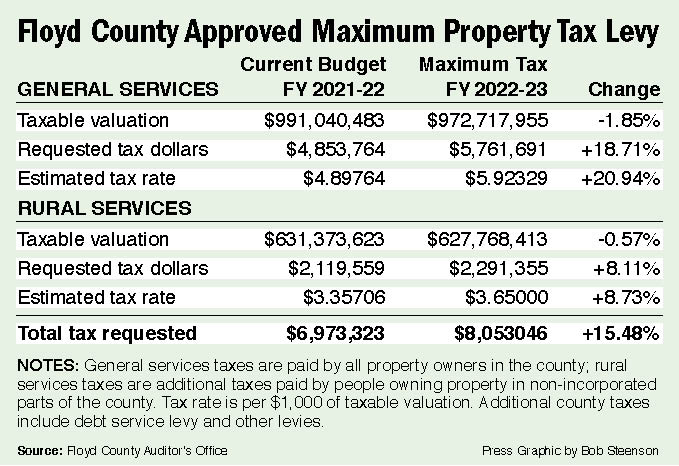

The approved max tax resolution sets the maximum tax that can be collected next fiscal year in the general services fund at potentially 18.71% higher than the current fiscal year.

That’s down from the 30.69% increase originally proposed.

That’s down from the 30.69% increase originally proposed.

The approved maximum tax that could be collected in the rural services fund was set at a possible 8.11% increase over the current fiscal year. That’s down from the 8.33% possible increase first proposed.

General services is the tax that all property owners in the county pay. Rural services is an additional tax that rural property owners pay to cover the cost of things like the Sheriff’s Office and secondary roads and bridge construction and maintenance, just as people who lives in cities pay a city property tax to cover similar city services.

Added together, the two county funds could collect a maximum of $8.053 million property tax dollars, an almost 7% drop from the previously proposed max tax, but still a 15.5% increase over the current fiscal year.

Most of the decrease in the maximum tax is due to the county making use of some of the $3.04 million it is getting in American Rescue Plan Act funds, to pay for expenses in the current fiscal year and proposed for next fiscal year.

One current budget projection calls for spending about $2.4 million of the ARPA funds on the law enforcement center (LEC) and courthouse projects and other expenses, leaving about $640,000 available for other uses.

One current budget projection calls for spending about $2.4 million of the ARPA funds on the law enforcement center (LEC) and courthouse projects and other expenses, leaving about $640,000 available for other uses.

The maximum tax resolution sets the maximum amount of property taxes the county can collect in the general services and rural services areas. It does not require the county to collect that amount, and supervisors said they would continue looking for ways to reduce spending as they finalize the county budget for the next fiscal year.

The maximum tax rate that could be charged actually increases more steeply than the total amount of taxes that can be collected because the total county taxable property valuation declined from the previous year.

As part of the meeting Monday, the board set the public hearing for the county budget for the next fiscal year at 4:45 p.m. Monday, March 28, in the emergency operations center in the (LEC).

In a late afternoon meeting that stretched 3½ hours into the evening, Supervisor Chair Doug Kamm started the maximum tax resolution discussion by telling the 20 or so people attending, “We’re not going to have a hearing — we had the hearing the other day. We’re just going to pass this resolution.”

Nevertheless, the board let the people attending the meeting talk just about as long as they wanted to before voting to pass a lower maximum tax resolution than the one originally proposed.

Many of the people at the meeting were the same as had been at the actual max tax public hearing a week earlier, and many expressed the same sentiments, voicing serious concern about the ability of people in the county to pay the higher proposed taxes.

They also repeated their urging for the supervisors to cut much more deeply into county spending, and again laid blame for the county’s financial situation at least in part on the board’s decision several years ago to continue with the LEC and courthouse update project even after bids came in significantly higher than initial cost estimates.

Mark Kuhn, a former Floyd County supervisor, said county spending and taxing have been on an uphill trend that is not sustainable, especially if property valuations should continue to decrease as they did this year.

But County Auditor Gloria Carr pointed to a chart that shows the county tax rate on a downward trend for more than a dozen years before spiking upward in fiscal year 2020 because of the more than a dollar extra debt service levy that voters approved to pay for the LEC and courthouse project.

Even at the current proposed levy the county property tax rate is lower than it was in fiscal years 2007 through 2009, the chart shows.

Kuhn said one of the reasons the tax rate could drop was that the property valuations had been continually increasing. Even though the levy dropped slightly, the county was continuing to collect more taxes each year because property was being valued higher.

That situation was one of the main reasons the maximum tax public hearing and resolution were added to the budgeting process for counties and cities three years ago by the state Legislature, Kuhn said.

“This is a tidal wave that is coming back on the property tax payers,” Kuhn said.

Carr and the supervisors have said that one reason for the higher potential tax asking in the next fiscal year is because of what happened during last year’s budget process for the current fiscal year, when an error in the wording of the maximum tax resolution that was written by Carr and passed by the board resulted in the county being able to collect only the same amount of taxes as it had in the previous year.

As a result, the general supplemental fund will end this year with a negative balance, requiring getting some money from the general basic fund.

A low carry-over balance in the county’s funds can leave it in a precarious situation, because it has to pay bills during the first quarter of the new fiscal year before new property tax payments start coming in, and because it needs funds on hands to deal with emergencies, Carr and the supervisors have said.

Kuhn asked why the board was trying to hide that error being part of the current problem, costing the county $1.2 million it couldn’t collect in the current fiscal year.

But Carr said nobody was trying to hide anything, noting that one of the reasons given for the proposed increase in the maximum tax was “work toward increasing fund balances to 20% carry-forward.”

Social Share